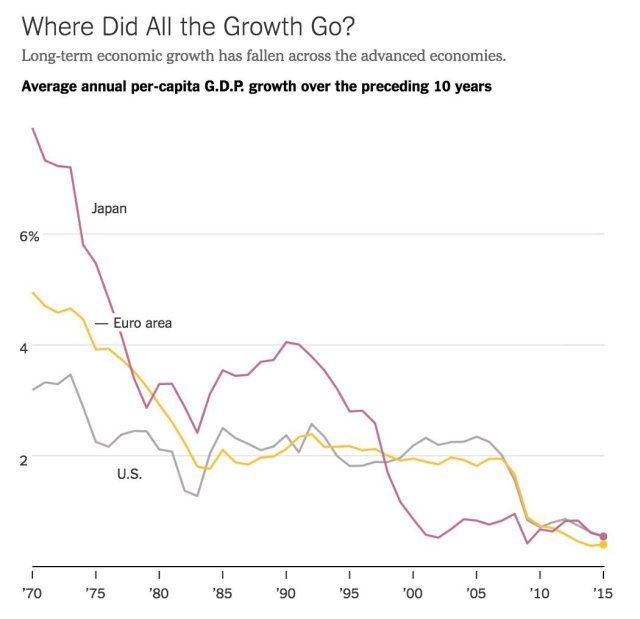

We have a problem.

-

Recent Posts

Archives

- December 2023

- December 2022

- September 2022

- May 2022

- April 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

Categories

- Aging

- Altitude adaptations

- Amerindians

- Archaic humans

- Ashkenazi Jews

- assortative mating

- Australian Aboriginals

- Book Reviews

- Bushmen

- Cold War

- Denisovans

- Dietary adaptations

- dysgenics

- Economics

- Education

- Eskimo

- European Prehistory

- Evolutionary Medicine

- Genetics

- Genghis -Khan effect

- GGS

- homo erectus

- Homosexuality

- Indo-European

- Linguistics

- Low-hanging Fruit

- Mangani

- Neanderthals

- Pygmies

- Skin color

- Speaking ill of the dead

- sub-Saharan Africans

- Uncategorized

- World War Two

Meta

How did this problem arise?

What was the GDP percapita on average for most of civilization?

200-300$. With a few exceptions, till very recently good times just meant more people, not more income.

Even before that, what was the rate of population growth among hunter gatherers for hundreds of thousands of years before agriculture? Low, very low.

Its like if economic growth doesnt have to be exponential or something. Sometimes technological levels and productivity gains not only stagnate, but even regress.

Im not saying that we have to be stuck on this level for centuries, or on the verge of a new dark age. Maybe we are like this just for a few more years, or decades. But the funny thing is that all the keynesian ponzi schemes DO need constant growth… And they have been trying to get it.

The rates of growth you see since the late 80s, have increasing levels of monetary heroin injected into them (“You have to stimulate the economy, you know. Kickstart it. End this depression now! “)

I was just thinking of our central bankers a couple of days ago, while hearing Greg´s podcast (Great stuff btw). That thing about not really being a good idea to just hope something will come along and solve everything.

the central banking mafia are the problem – they hijacked politics after the collapse of the soviet union and have been trashing everything since

“What was the GDP percapita on average for most of civilization?

200-300$.”

No, much higher, by a factor of 10 in most of European history.

Well, it kinda went over here to Eastern Europe, and probably even more to China, didn’t it?

Or at least the measured part of production increase did. IIRC, the graph of world GDP growth is doing fairly well.

Yes. Dygenesis a possibility, but doubtful for Japan, which also has little unselective immigration, unlike US and Europe. Perhaps Southern Japanese have become more fecund.

https://drjamesthompson.blogspot.co.uk/2015/09/north-south-divide-japanese-style.html

Ken Kura thinks they lack curiosity

https://drjamesthompson.blogspot.co.uk/2015/09/asians-bright-but-not-curious.html

In fact, there has been an uptick in Nobels for Japan very recently.

On a personal topical note, having just met him last night, I think VS Naipaul was a Nobel Laureate in Literature who actually deserved the prize.

“there has been an uptick in Nobels for Japan very recently”: does that mean there was an uptick in Japanese science twenty or thirty years ago?

Possibly

The simplest explanation for Japan’s dramatic drop is that its economy was closer to a developing market in the nineteen-sixties and has been moribund since the nineteenth-nineties for largely self-inflicted reasons (it does not allow competition into its service sector, for example).

not allowing the banking mafia to their financial sector is the single wisest thing the Japanese have done

Japan’s problem is they were the number one middle class economy exporting nation so when the middle class economies world wide were trashed by US corporations off-shoring to China they had the furthest to fall

It goes much further than just the financial sector. It includes retail services, which is a huge part of any modern country’s economy. And the Japanese government is trying to solve the problem.

We’ll see to what effect. The Japanese are notoriously hidebound. When they absolutely have to change, they are remarkably adept at doing so quickly; but when they don’t have to change, they don’t move.

fair enough

“On a personal topical note, having just met him last night, I think VS Naipaul was a Nobel Laureate in Literature who actually deserved the prize.”

A very fine author of non-fiction. Deserves much praise for noticing what the great and the good try so very hard to ignore.

Calhoun rat experiment type stuff is happening in Japan. Young men are getting lost in anime and video games and not dating/reproducing/working.

I for one think that Greg needs to discuss the evils of anime and why men have started to prefer 2D waifus to disgusting menstruating real-life 3D women.

It’s fairly obvious for the West. High immigration, high unemployment, outsourcing, etc. We don’t tend to produce things, but when we do, the money goes somewhere else. Pretty sure the closest thing we have to an economy is the petrodollar.

Japan has no excuse. Except possibly their genetics. Collectivist cultures produce less (http://eml.berkeley.edu/~ygorodni/gorrol_culture.pdf) and, most likely, the genetic propensity for collectivist tendencies varies globally (http://rspb.royalsocietypublishing.org/content/early/2009/10/27/rspb.2009.1650.full.pdf+html)

In any case, that research might explain why Whites invented algebra, geometry, calculus, the chariot, bronze, the printing press, airplanes, the Periodic Table… etc, etc, while the Asians did compasses and gunpowder. They’re smarter than us but tended to accomplish a bit less. Unless Asian brains are a recent phenomenon, something else had to be at play.

That said: it’s the individualists who swarm themselves in dum-dums.

It’s possible that most societies have pretty much reached their apex, the maximum point where their genes can take them- at least for now. There are a few individualist countries that rejected immigration, rejected the EU, etc. I wonder how to make other Ethnic European countries more like Switzerland.

Indeed. The crazy thing is how little attention most of our elites seem to be paying to it. As for the nature of the problem itself, oversimplifying, the two main credible arguments I’ve heard are:

Chicago School, John Cochrane: It’s “structural” – far too much very expensive regulation, there’s empirical evidence suggesting we could get much richer much faster if we tried, etc.

http://johnhcochrane.blogspot.com/

Market Monetarists, Scott Sumner: It’s bad monetary policy – the central banks (in Japan, Eurozone, USA – but not Australia) have been systematically screwing up, keeping NGDP growth (and thus also inflation) too low, giving us a depression.

http://www.themoneyillusion.com/

I suspect they are both right, but of course on different time scales.

Plus a spot of demographics. The people who “give a bugger” have all retired.

There’s been chattering in the press for years about this. Even some speculation that the problem is artificial in that the standard GDP measures don’t measure the recent improvements in life accurately.

The two reasons given are self-serving bankster nonsense.

” The crazy thing is how little attention most of our elites seem to be paying to it. ”

They’re bought and the people who bought them are still benefiting from the current policy.

There’s a third view: Robert J. Gordon lays it out in a book I’m reading: The Rise And Fall Of American Growth. Gordon has been studying this for decades (and he’s 75 now). It comes down to harvesting the low hanging fruit with really big benefits and then finding what’s left is harder to automate and new inventions aren’t as impactful.

We still have some big benefits somewhere in the future, most notably rejuvenation therapies. But when?

Just read it. Problem is, Gordon isn’t an engineer, doesn’t have a clue about technological trends.

I don’t think Tyler Cowen is an engineer either, but FYI:

Average Is Over: Powering America Beyond the Age of the Great Stagnation

The Great Stagnation: How America Ate All The Low-Hanging Fruit of Modern History, Got Sick, and Will (Eventually) Feel Better

I’m a big fan of the “Grumpy Economist” Cochrane. Another great economist who basically agrees with Cochrane is John Taylor (of the famous Taylor rule):

This paper also explores what can be done from a policy perspective to improve productivity:

Click to access Slow_Economic_Growth_As_a_Phase_in_a_Policy_Performance_Cycle-March2016.pdf

Their basic message is = back to basics.

Population loss, especially of smart people. It isn’t hard. Japan is losing one million workers every year. How in hell are they supposed to grow with 1 million less people again and again?

comfort breeds complacency; complacency breeds liberalism; liberalism breeds destruction; destruction breeds realism; realism breeds comfort…

we appear to have been stuck in this cycle since the Roman times.

That must be it, Japan being more liberal than the USA… Oh, God.

Well, the curve shows that they are growing. Just not as fast as before.

You might want to check where (to whom) that small amount of growth is going.

“American median household incomes, adjusted for inflation, have fallen 7% since 2000.”

There’s been income decline for the bottom 80%, about the same for 80th thru 90th, some gain in top decile – concentrated in top 0.1%.

Good thing I’m in the cognitive elite.

On the other hand, American median real household income has risen since 1970, which is when your chart above starts. Which fact is a better predictor of the future?

A lot of that increase has been due to women taking jobs outside the household. Hard to see how you do that again.

A lot of that ‘gain’ was just monetization, by the way.

(Now-Senator) Elizabeth Warren and her daughter noted in

THE TWO-INCOME TRAP–Why Middle-Class Parents Are Going Broke

almost 9 years ago now (so October of 2007) that, starting in 1970, American middle class families sent their wives out to work. What she did not take her analysis far enough to discern is why: basically to support the permanent, multigenerational underclass created by Lyndon Johnson’s Great Society programs.

The biggest cost to the middle class of its underclass shows up in housing, commutes, and health care, not directly in taxes, but the Trump phenomenon is evidence for the productive classes figuring out that they are being impoverished government-policy-driven cuckoldry.

Men, women, and the third demographic shall be robots.

Assuming that virtually every blue collar job can be automated with adequate robotics tech: that probably leads to a dystopia with 90% unemployment and a wildly dysgenic breeding pattern among that bottom 90%, right? If your grand master scheme is to turn America into India, bring in the robots and Mestizos.

I guess India is nice- for those Brahmins in the top 0.1%, anyway.

“American median real household income has risen since 1970”

housing costs rose more and women going out to work to compensate has already been done

Yeah, thats very true, but not everywhere:

Its like if not flooding your country with millions of foreingners, specially when they have lower human capital on average than your people, and to top it all, there is no growth to speak of, is a good thing.

…Or that is good that the elites of a nation care about their own people.

…Or at least they consider them they own people to begin with, and not some other people in the middle east.

It shouldn’t be surprising that the immigration of large numbers of poor from Mexico and elsewhere has depressed that metric.

productivity increases > population growth

A few causes are well known; demographics (esp small babyboom families & consequently dull migrants filling their places) on the one hand and affirmative action, overregulation & monetary policy on the other hand.

But there’s other stuff, too. Innovation – the real kind, like inventing airplanes, rockets and transistors, not USB sticks and apps – has gone down. The state could invest in giant programs, like Apollo, Manhattan Project & DARPA much more; VC’s, contrary to SV agitprop, don’t fund long-term fundamental innovation. They mostly fund a sure win, Peter Thiel is an exception.

I once interviewed a mildly famous Dutch physicist (not for physics, btw) who knew Martinus Veltman. He told me that Veltman told him it was easy for him to keep with the physics journals, because not much interesting had happened since the mid-70s. Now, I’m no physics expert, not by a long shot, but as someone with a lifelong interest in innovation, I knew (if true, and no joke) that was a very bad sign.

“not much interesting had happened since the mid-70s”: in particle physics that seems to be true, according to my friend The Particle Physicist.

But they seem still to have been making stuff up in cosmology and all that.

The LHC keeps confirming the Standard Model (ca. 1970’s), so maybe there isn’t anything left to discover.

The lack of technological innovation since the 70’s may have the same cause.

That’s my suspicion.

“maybe there isn’t anything left to discover”

http://backreaction.blogspot.in/2016/08/the-lhc-nightmare-scenario-has-come-true.html?m=1

Also “He who must not be named” – is that in reference to Greg or am I missing something?

Can’t be me. Motl?

The one asserting that there is “nothing new to be discovered” can’t be you (Greg Cochran) because my single biggest public policy crusade is to get the Congress to put a gun to NIH’s bureaucrats and have them throw money at proving/falsifying the thesis put forth in:

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.182.5521&rep=rep1&type=pdf

Even a budget conservative can see that either we beat Alzheimer’s, cancer, and heart disease medically or they will beat us fiscally. Note that Fred Upton’s 21st Century Cures Act was the first bill reported out of his Committee on Energy and Commerce unanimously in THIRTY YEARS. It’s a tiny start, but it is directionally correct.

You are so busy you are forgetting your previous (16 years ago) genius observations!

(It is fortunate that Chairman Upton finds himself in need of re-defining himself after abruptly being re-cast as merely “Kate’s Uncle” .)

Some researchers suggest that oncogenesis is more about a deformed karyotype than about oncogenes. If that’s true (I wouldn’t know), and someone uses it to come up with something big, then we could see more progress.

There is no other candidate except Motl. Seems to have taken that particular article quite badly, from looking at his blog. Still, he does have a point under the reflexive abuse and labelling of those he considers to be wrong. The

racism/sexismas well is usually just common sense stuff.I would like to add to Bob Sykes observation because i think he is on to something. The economic stagnation is the result of two trends coming together which results in no real growth. First we have diminished technological innovation and second we have the increasing expense of natural resources because of greater demand for it by a larger human population.

Going further into the demographics of this trend we have the result of the rich getting richer and the middle class getting poorer. Rather than getting stupid and whining about the unfairness of this trend (it isn’t fair but whining about it and then pining the blame on simple answers to complex questions doesn’t help) we need to step back and look at the big picture.

Birth control was going to happen. It could have been by the horrors of the Malthusian trap, it regrettably is the logical outcome of that poor billion plus people in Africa. In the first world birth control was going to happen not just because of the pill but also because who in the hell is going to raise more than two kids when they can barely take care of themselves and their kids are not going to pay back the favor. Look at humanity as bacterium in a petri dish and you start to see the obviousness of this.

You look at the populations that hit the wall in increased prosperity for the middle class and almost exactly at that time women ceased having more than 2.1 children.

You can be an idiot and think some guy in a red baseball cap can make us all live like billionaires or you can try to grasp the complex picture of humanity.

I an an old computer guy, and I am grateful that when I entered the workforce, the growth of my sector of the economy was not considered a national emergency that had to be strangled by all means necessary. I am, of course, referring to the current universal consensus that America is spending “too much” on health care and we must stop that part of the economy from growing!

Alas, market capitalism is deflationary. Without new economic “superior goods” (ones that as GDP/capital grows, the percent of GDP devoted to them goes up) being created, dollar GDP/capita will simply go down as the price of “inferior goods” falls. The part of health care I like to refer to as Serious Medicine is the ultimate superior good. If you would argue with this, then tell me how much money would have been too much too spend on a course of antibiotics that would have beaten Henry Harpending’s hospital-acquired sepsis. Or how much money would have been “too much” to pay for Greg Cochran’s recent heart surgery.

Of all people, the late senator Teddy Kennedy had the right solution to the high cost of health care. Oh, not the fossil that inspired the Affordable Care Act (ACA), but the young, vigorous man he was when he first entered the Senate, and his aides came to him and asked:

Q: What do you want done about the abortion bill?

A: (turns red in the face, leans forward and urgently whispers:) “Pay it!”

if you look at the propaganda being put out by western countries, we are led to believe that the future of innovation is ‘programming’ pointless apps.

Are you implying that the ‘Kookyer Kats’ app that gives me hints to get to higher levels on my ‘Cookie Cats’ game app is POINTLESS?!!

I’d like to see you get past level 672 without paying at least 100 USD for ‘refreshments’ and ‘extra milk’.

These days it can take years for even the guys at the frontier to try verify attempts on the big problems in math. I’m not no expert in either math or physics but I suspect they may have reached that stage where a lot of the big problems are just too cognitively demanding and time consuming to solve?

And that shouldn’t be too surprising. We know there is an upper limit to how far low-performing groups can go when it comes to civilization (intellectual and economic productivity). That limit may be way out for others but diminishing returns doesn’t seem to apply to cognitive ability when it comes to math and science.

Maybe current humans just aren’t smart enough to ever solve the Riemann hypothesis. If that’s the case, it would apply to the potential for technological innovation too.

I’m not qualified to talk about the frontiers of physics, but there’s still a lot to be discovered in all sorts of scientific disciplines. Partly, lack of fundamental innovation is a resource problem. OECD states should increase their R&D investments to, say, 4% of GDP. I bet you everything that you’ll see breakthroughs in all sorts of scientific areas.

Why aren’t we doing this? Ideological blinders

– Free market ideology claiming states can’t innovate

– Affirmative action and similar repugnant policies that frustrate the education of worthy human talent into scientific jobs and positions.

– Schools should focus on selection of rare talent — helping the dull is less important, than helping the smart

– It would help economic growth a lot if we’d start taxing rent-seeking and wealth over value creation and work.

Etc.

The field of mathematics has seen almost continuous progress since the 18th century, with no sign of slowing down. To give an idea of how rapid the progress is: papers from a generation later (20-30 years say) are often difficult to read for the older generation.

Yes the cognitive demands have increased over the years. More importantly than raw (fluid) intelligence is the vast amount of crystallized knowledge. This has increased exponentially. I personally estimate that in terms of true raw intellectual content Mathematics is larger than all other scientific disciplines -save perhaps Physics- put together.

Mathematicians have reacted by extreme specialization. The amount of background knowledge one needs in a typical specialization has increased linearly; the amount of subdisciplines have correspondingly multiplied. This is posing serious challenges in the ability of the mathematical community to judge new work. The case of S. Mochizuki is of course as famous as it is rare, the phenomenon goes much deeper. Recent Fields medal committees have admitted that they often have difficulty judging the relative merit of proposed candidates. At a more mundane level hiring decisions are done largely on trust, since most of the people will have no idea what most of the candidates actually do. The degree of specialization is difficult to convey to people outside of mathematics but I will give it a try.

The 2010 AMS subject classification lists about 70-80 different subfields[1]. A strong mathematician might know about 6-8 at a a level sufficient to

– give a basic graduate course in one of those fields

– understand a ‘broad-audience’ talk[2].

– superficially follow a technical talk or paper but most likely will not be able to really understand anything but a broad outline

– Know most of the ‘classical’ (~20 years back) big theorems and definitions

however they will likely be unable to

– read most papers in the current literature or understand a technical talk at a deep level

– know more than a tiny fractions of the proofs/technical details of classical results by heart.

A strong mathematician might know 1-3 fields at a deep level. A truly brilliant mathematician like Terence Tao might know ~8-10 fields at this level. At this level one

can understand technical talks and papers at a deep level

is aware of recent developments, though outside their own research specialization might not understand the details of these developments.

know most of the big theorems and definitions and can summarize most of the proofs and technical details of ‘classical work’ (i.e. big breakthroughs done 20 years ago).

do actual research in these fields (although according to some only ~200 people alive are making significant progress at any one time; as compared to working out details of previous breakthroughs).

Some fields, often with algebraic flavor, lean toward extreme abstraction and heavy machinery. Timothy Gowers calls these 1st culture subjects. A strong student in those fields might need >10 years starting from freshman year; the usual duration of a college+grad school is often not long enough to do serious work. Other disciplines, often with an analytic or combinatorial flavor, will typically require less background knowledge Gowers call these 2nd culture subjects. Obviously there is a continuum between these two extremes.

A nice account by Gowers is given in: https://www.dpmms.cam.ac.uk/~wtg10/2cultures.pdf

I might add that the classification of sub-fields given by the AMS is a little dated and arbitrary. It most likely vastly understates the amount of specialization in some of the more 1st culture disciplines and overemphasized older fields. Most of the disciplines listed are fields in analysis.

For instance the field of algebraic geometry is a single subdiscipline; this is a hilarious understatement of the current specialization. It is perfectly possible for two people who both call themselves algebraic geometers to be unable to read each others papers.

This classification has more to do with funding/# of mathematicians in a given subfield than an equal division in intellectual content.

A more up to date classification could justifiably split fields like algebraic geometry, number theory, logic and others into ~8 sub-fields and could easily double the AMS classification.

In conclusion, I see no evidence that progress in mathematics (and by extension in theoretical physics) is slowing down, to the contrary it is seems growth is steady or even increasing.

Yes it is very possible that there is fundamental knowledge that is beyond the grasp of (unaltered) humans. But I see no evidence that we have reached that point. What is true, and I hope I emphasized enough, is that we experience and will continue to experience an enormous degree of specialization.

[1]http://www.ams.org/msc/msc2010.html

[2] The meaning of ‘broad-audience talk’ has strongly shifted over time…

An acquaintance abandoned physics after realizing it entailed a lifetime of wrangling Mathematica. What’s the view on that from the math side?

Mathematicians use Mathematica sporadically. In most fields of Pure Maths equations that require the use of Mathematica rarely come up; even in those cases were it is used, it is mostly to aid intuition. There are of course exceptions, but even in a discipline like PDE’s most work is completely conceptual.

That is not to say that the use of computers is inessential; work in (algebraic) number theory, modular forms, elliptic curves etc. greatly benefits from more specialized programs (like Sage) than Mathematica. However this is mostly used as a research/teaching support but rarely forms the basis of a paper.

On the physics side computing/coding is getting increasingly important as I understand it. We would often joke that every next level in Physics merely repeated the same maths, but all the formula’s are much longer.

Most serious calculations in even an older field like General Relativity can take hours by hand. A slightly comical but real problem is that sometimes equations can be longer than the width of typical writing materials.

This shouldn’t be overstated on the other hand; formulas get bigger and bigger, calculations get longer and longer and computers are increasingly important even in theoretical work. But in the end calculations are but a small part of Physics research; the real work is coming up with new formulas/mathematical.techniques/models

Even though I think there is a case to be made that we have seen no slowdown in theoretical advances I do think we have seen a marked slowdown in technological improvement compared to say, the 1900’s.

Would a highly intelligent, high spirited polymath dream of becoming a scientist nowadays? Year after year of training, more years of working on other people’s problems until he has a chance, damn near in middle age, to work on his own problems, but all the time constrained by the search for funding, and wearied by university bureaucracy and managerialism.

It sounds like a mug’s game to me for all but obsessives.

How much of 19th century algebraic geometry has already been forgotten?

cheap labor for low productivity jobs (like picking fruit) lowers average productivity in the present

cheap labor kills the incentive to innovate so kills higher productivity for the future

productivity is the only route to prosperity

however cheap labor is good for large employers of labor (in the time before the economy stagnates) and they pay lobbyists

I took a class on field theory from Veltmann in the 90’s. He was pretty indifferent to the idea of teaching us anything. He spent most of our class time telling us how much he deserved the nobel prize (which he had not won yet). Classy guy.

Historically, 1% is normal.

All the low-hanging fruit that enabled high growth due to better technology has been picked in the last 150 years.

And also I suspect the debt isn’t making anything better.

This is my feeling as well. The HBD economist pseudoerasmus has also talked quite a bit about how growth from 1945-1973 was an aberration, particularly in terms of what it means for developing countries.

PE has also hypothesized that, in wealthy countries, the basis for policies since the 1980’s that have favored the rich and increased inequality is the rich wanting to preserve 45-73 style growth for themselves, and having the political clout to achieve it.

Historically, a lot closer to zero than 1%, if we’re talking per-capita GDP

I suspect “j” is talking about the period since the Industrial Revolution began. There have been long periods of relative economic stagnation within the last two hundred years.

How many people, for example, know about the Long Depression? Most scholars look at it as just the extended 1873 Panic that lasted until the end of the eighteen-seventies, but some see it as a much-longer deflationary period that was bookended by the 1873 and 1893 Panics.

What does it even mean? We are back to a government official estimating what a 14th century house would sell for today.

Look at military technology. There were enormous, paradigmatic advances in technology between 1200 and 1600. Yet apparently there was almost no growth in this time.

Progressives tell us that economic growth began when progressivism was born. Well, they would.

MALTHUSIAN.

An American Civil War army of 1850 was similar in size and fighting style to an English Civil War army of 1650, but totally unlike an army of 1950. An English Civil War army was totally different in fighting style to an English army of 1450.

If you look at armies – their size and level of capitalisation – there seems to have been a fairly steady ramp-up between the end of the dark ages and today, not a sudden break with some industrial revolution that happened to coincide with the birth of progressivism.

The size and level of capitalisation of armies experiences a steady ramp-down between the early Roman Imperial period and the establishment of the European monarchies. The fall of the Roman Empire itself seems to have been a symptom rather than a cause.

I have only started reading a bit of history. From the little I’ve read, it seems that both economic growth and population explosion are relatively recent phenomena – around the time of the start of the industrial revolution. May be one of the bright sides of this slowdown in growth is going to be reduced population growth. I understand that the average growth rate in Africa is still too high – and even if it slows dramatically now, the demographic momentum will cause population growth for at least another generation. But even there, there will be breaks on the growth – and I’m not sure it’s guaranteed that all the breaks will be the result of some catastrophic factors. I’m an optimist.

I have only started reading a bit of history. I’m an optimist.

Read more, you won’t be.

Reminds me of the quip:

What’s the difference between an optimist and a pessimist?

An optimist believes this is the best of all possible worlds and the pessimist is afraid the optimist is right.

How much do we trust GDP?

GDP is a measure of the money supply multiplied by the velocity of money. All information about growth is contained in the GDP deflator which is ultimately a subjective, discretionary measure. GDP probably has many of the same problems as GOSPLAN’s measurements.

Economic growth is not correctly measured by increasing income, but by decreasing prices. Clearly prices have decreased unevenly across the range of goods and services available for purchase and many important goods and services have increased in price.

The GDP metrics chosen are almost always laughably insensitive to demographics. Why is it GDP per capita rather than per working age adult? Should we have adjusted it down when more women entered the workforce, since we would expect more workers to increase GDP even if there had been more “real” growth? Why don’t we adjust for the average age of the work force, since the average 50 year old earns a lot more than the average 25 year old?

I think you have touched on one problem with the current metrics. It has always been assumed that as money changes hands more quickly, prices rise. Therefore, increases in velocity must mean an increase in nominal GDP. The technological age may have made this less than useful as money can rapidly churn through the system not because of demand, but due to the efficiency of electronic currency versus stacks of cash or bags of coin.

This of course gets to the greater issue, which is the definition of money today versus prior eras. The debt levels of today were impossible under the currency arrangements of the 1960’s. Those growth numbers are mostly likely a sign that we have reached the point of diminishing returns with regards to the present currency arrangements.

The huge move of childcare into the marketplace (as mothers went back to work) is one example of a problem with GDP–we started paying cash for stuff we used to do via family organization, so even though the same stuff was done (kids were watched), GDP went up.

Similarly, a lot of really valuable stuff is free that used to cost money (blogs, encyclopedias, college lectures, porn), and that shows up as a loss in GDP even when there’s more of those things available now.

One problem that is recognized, but it seems nearly impossible to fix, is the correction of prices paid for the “quality” if the thing paid for. As an extreme case, consider Facebook. In some sense, it delivers a tremendous amount of benefit to its subscribers, because they willingly spend an incredible amount of time using it. And yet its contribution to GDP is (I assume) basically the amount of advertising they sell. The problem being that the users don’t pay for it (directly), so there’s no way to measure the ratio between “what they’re getting” and “the price they’re paying”.

“The Great Divergence” refers to the economic effects of the Industrial Revolution that started in Britain in the 18th century. Some people like to think that it guarantees us growth far higher than in all the rest of human history and pre-history. But I’ve never seen anyone make a case for why a guarantee is available, and from whom.

As long as you believe that technology will continue to improve, and that enough incentives will remain in place to apply these new technologies in practical labor-saving and resource-saving ways, then you should expect continued per capita economic growth.

Is this guaranteed? Nope. But look at the huge changes in the U.S. economy over the last two centuries. Look, for example, at the growing size of government. It was practically nonexistent in the 19th century, and it’s now omnipresent. Yet growth continued despite the growth of government and despite many predictions to the contrary.

Gawd awful monetary policy has a lot to do with it. The government is not a household. They are the issuer of currency. It must spend and always be in a deficit. The way these countries/zones run fiscal policy is a nightmare. It would be akin to the MTA having long lines everyday because they needed to wait and collect the tokens of the current riders to re-issue to the next riders. It is ludicrous, of course the government is in deficit. If it wasn’t it would be sucking money out of the pockets of its populous.

QE is not inflationary, quite the opposite. It takes interest bearing securities (i.e. more money) out of the market and replaces with non-interest bearing reserves. Tax cuts would be an effective economic stimulus because it puts money in the hands of the people. The government does not need to collect taxes to fund the government. Again, it is the currency issuer. Government spending on infrastructure projects would also be stimulative and they are much needed, to boot.

The eurozone is in big trouble because they have umpteenth amount of countries that all have different economic needs. A sovereign nation must be in control of its own currency or else it ends up as Greece. I fear for Italy, beautiful lady that she is.

Japan has been doing QE for a long time. It will not end well. They should be raising interest rates. They have a majority of people that put all their savings into gov’t bonds. Raise rates and everyone will instantly have more money, or at least think they do, which can be just as stimulative.

Yes, demographics and a shift to a services empire have much to do with it as well.

Ok, rant done.

QE is the central banking mafia buying worthless assets at cover from corrupt banks with public money – or public debt at least.

It’s been non inflationary because of the black hole inside the banks after 2008.

Modern Monetary theory, yay!

Even though I agree with your underlying macroeconomics, I’m not sure the current slowdown in Per Capita GDP is caused by the fact that everybody at the top is completely and laughably incompetent. Per Capita GDP growth is mostly pushed by technological development, i.e., smart people’s work. But smart people are already close to full employment.

Well, I think where smart people are employed is a big problem. Hedge funds and law firms are parasitic productivity killers. A lot of tech is just useless nonsense. So, yes, we need more smart people creating innovation.

If you fix the things at the macro scale it might work out that a micro scale student mired in debt doesn’t feel like he has to accept a position trading crude oil futures to pay his way out of that debt. Young people are generally more productive and creative. We take our young people saddle them with insurmountable debt and then expect them to “do the right thing.” If I had mega student loans I’d be out there slinging West Texas light sweet too.

I don’t think it’s easy to see ahead of time what will be trivial and what won’t. Lots of people thought personal computers were useless toys, but they’ve turned out kinda useful. I think cars and airplanes were seen the same way when first introduced.

I also don’t think technology has stagnated, or that we’ve picked all the low hanging fruit. (Lots of innovations seem obvious in retrospect, but they weren’t obvious at the time, or they were hiding in a forest of dozens of equally obvious ideas that wouldn’t have worked.)

David Stockman has written quite extensively on this era being the debt bubble era. This began in the 80’s and it is likely to get worse before it gets better. The debt, private and public, overhang weighs on the economy. There is a reason why the sensible billionaire Jim Rogers moved to Singapore and Asia. As he says “[t]he 21st century will be the century of China. First of all, the largest creditor nations in the world are all in Asia now. The largest debtors are the US and Europe. Most of the assets are in Asia.”

However, for now it is possible to maintain the current society at these debt levels so it will until it doesn’t of course.

I’ve been reading the quarterly newsletters from Hoisington Management, who only invests in long-term Treasuries. They’ve handily beat the S&P 500 by a few percentage points over the last 20 years. I feel like they have a pretty good grasp on what’s occurring and put their own money on the line to back up this belief.

Their view is grim. As you stated, debt, especially federal debt, overhangs on these economies and restrains economic growth in a non-linear fashion. They cite a paper that once an economy hits a debt-to-GDP ratio > 90% for at least five consecutive years, economic growth slows significantly. You can see this occur with all the major world economies, e.g., Japan, US, Italy, etc.

The thing is, nobody is really talking about reigning in government spending and reducing public debt. Our country believes that having the government spend more money will propel us out of this slow-growth period. But the government-expenditure multiplier has appeared to have gone negative given the massive amount of public-debt increase since 2009, with a growth rate that is less than half of the average growth rate following a recession in previous times. I fear it will take a long time and a lot of failed experiments and wasted money until we come back to our senses.

Thank you for this comment. Artificially helping the economy short term by public debt increase is financial child molestation. If you spit on the political ideologues on both sides for rampant foolishness but among other things want your government to balance the damn budget than the best strategy is a democratic president and a republican congress. If either party has control of both presidency and congress then they spend money like drunken sailors with lots of credit cards. Republican presidents (Eisenhower excluded, bless his soul) think like a CEO who only gives a shit about the next quarters profit, and simply love to run up the debt. But somehow someway the democratic congress is more inclined to run up the debt than a republican one. So from a practical point of view you face the facts that the idiots are going to elect idiots and the best idiot combination is a democratic president and a republican congress.

I took Econ-101 in 1968 and I have been unable to shake what I learned about the intersection of Supply and Demand curves. What I see are the financial markets screaming for more U.S. debt to buy. (The price of Treasuries of all maturities keep rising.)

World’s worst investment: Locking your money up at negative yields for a decade or more in a security denominated in fiat currency with radical, inflation-seeking monetary policy the order of the day. $13 trillion in sovereign debt trades at negative yields today, madness. Will not end well.

None of the major world economies will be able to handle their debt levels. And that debt will be even higher in the next recession because politicians are out of options except for more spending+debt after The Great Moderation killed of any idea that economic planners had gotten the hold of fluctuations. Remember that besides these official debts you have the off budget items which are far bigger.* However, we are at the tail end of the debt explosion. America will hold out longer than Europe or Japan because America is still the go to place for debt but they will will default although this is unmentionable in polite society and considered beyond the pale. And when default does come it will be dressed up in euphemisms.

*See this brief clip of pundit luminary Thomas Friedman and his vapid response when confronted on inevitability of Social Security default:

Not to reassuring

The great economic default will be the issue for the next generation and it will have wide ranging implications for all sorts of other political questions. For example state governments will be far less subservient to the federal government when it is no longer there to bribe them to do the latest craze. Second and third tier universities will be closed which is a good thing since it will help prick the university bubble. I’m sure there will be a ton of other consequences beyond my imagination as well.

You know, this is nonsense, and almost all the other blathering about the economy in the blog is also nonsense.

Blah blah blah blah. Tiresome.

If you have a way to avoid the inevitable default you will become a much vaunted man.

When it comes to the debt and unfunded liabilities I will trust Stockman and Kotlikoff.

http://www.garynorth.com/public/13547.cfm

If the estimates are to be believed, China is also among the most indebted nations in the world (~250% of GDP all-in (corporate, gov’t, “shadow banking”)) much of it accrued post-2009 by state spending on infrastructure in an attempt to stimulate and prop up unproductive industries in an attempt to maximize employment, incidentally resulting in the greatest misallocation of capital in human history (still-empty Ordos, etc.).

Further, recent estimates of China’s actual GDP growth are as low as 1%.

Finally, China’s one child policy will have an impact on its future growth prospects as its age structure becomes top-heavy.

Perhaps China is headed towards being more like Japan?

yes – the debt is a large part of it

debt-based consumption (usury) reduces total demand over time – it doesn’t look like it does because borrowing initially increases demand – it’s the debt repayments that reduce demand by more than the initial increase over the course of the loan

(inevitably so as making a profit from lending money requires taking out more than is put in)

The problem with government spending is not “the debt”. The problem is the spending, which sends the signal to the economy that what we need is more of the things governments “borrow” to pay for. Northern Virginia is becoming a very wealthy region, because that is where they manufacture what our government likes to purchase.

The debt is eventually lethal, but yes, the mal-investment that created it is also toxic waste.

Birth rates?

Selection bias. The chart shows peak to trough.

The nineteen-fifties and -sixties were a famously productive period in the economic history of the West and Japan.

The last ten years, on the other hand, have been infamously unproductive for those same regions.

Yes, those areas could still be in a long-term decline, but because of the timing used in the chart it’s most likely exaggerated by the illustration.

For perverse reasons, people are especially interested in the present.

Then measure trough to trough.

A chart estimating per capita growth in lagging ten year increments from 1940 to the present day would look much different than the chart above.

http://forward.com/news/national/347207/how-the-alt-right-manipulates-the-data-to-prove-the-existence-of-race/

Wow this is a dumb article. His point is that populations differ, but not by a lot, so it doesn’t matter. Ok, but then he goes on to write that a tiny bit of genetic variation is the difference between being likely and being unlikely to get alzheimers.

They differ in phenotype by as much as they differ in phenotype – in IQ, by quite a bit. . When you see the same pattern everywhere on Earth, you have to suspect it’s genetic.

How people can believe as apparently many do that genetics has nothing to do with say the extraordinary levels of Ashkenazi intellectual achievement utterly astounds me.

Growth for the sake of growth is the ideology of the cancer cell.

Update: it is the ultimate “ideology” of all life.

even if you had a zero growth policy for green or other reasons productivity growth is still win-win as you get the same output for fewer inputs

productivity > all

Well, the big economies keep pumping money into the banks. Because money is free and basically worthless at a certain level, the large banks are careless with whom they lend. It doesn’t matter anyway since most loans are federalized now. Aside from interest rates being kept artificially low, that has led housing prices to be ultra-inflated.

The big economies, Germany, Britain and the U.S, in particular, are using migration to inflate real estate and consumption. Whole industries are subsidized by cheap labor, including the government healthcare system, tech and universities. More government policy, like a federal minimum wage and healthcare above 40 hrs a week, ripens the incentive for illegal immigration and more part time work.

Everything is fake. Buy cigarettes and ammo.

1) Elimination of international industrial redundancy due to globalization of manufacturing etc.

2) Long-term stagnating, low birth rates in the industrialized world (not counting dysgenics, which is not yet the real issue).

Nationalism, strong law, and recognized inequality of outcomes is the answer.

Why do some ppl think all low-hanging fruit is gone? The proponent of this meme, Tyler Cowen, has been wrong about nearly everything his whole life. Bad source.

Just google “R&D investment + country” to get an idea. It’s a low %, imo. Only China still does big 5-10 year plans. Do Western nations? Some of that, yes — but we could do way more.

It’s hard to invent breakthrough stuff solitary, in your garage. In that sense, the lowhanging fruit might be gone. That’s why you need CERN, DARPA, Apollo, etc. these days. Innovation is not necessarily over.

Apollo was the worst thing that could have happened to the space program if you wanted anything beyond flags and footprints. We might as well have just burned all of that money for all the good it did us.

Greg, how much of this is due to the misallocation of the small fraction of people capable of innovation, i.e. an ever increasing number of bright people doing neutral-to-harmful things in finance, medicine, academia, and law?

You other guys: there are many plausible explanations for slow developed world growth. Excessively loose monetary policy is not one of them. Econ is rightfully not respected much around these parts, but there are some real monetary experts out there, with real thick knowledge of monetary history, who are actually interested in prediction* rather than showing off their math skills. Read them – not the Austrian, libertarian, goldbuggy types – or just accept that monetary policy is too complicated to have an opinion about.

*Goldbug libertarian types (especially investors and money managers but NOT academic libertarians who actually tend to be alright on macro) claimed in 2008 that printing money would cause hyperinflation. It didn’t. Now many of those same folks claim printing money depresses nominal GDP growth. Shrill throughout despite a sign error.

Who is ‘them’? Do you have any names?

“claimed in 2008 that printing money would cause hyperinflation. It didn’t.”

The banks had trillions in toxic assets in 2008 but no-one said because it meant they were all bankrupt.

(toxic = for example, assets with a face value of a million that were actually worth 100k)

So the central banks printing money and using it to buy toxic assets from the banks at face value didn’t add any money into the system – it simply erased a negative.

When the housing bubble eventually fully unwinds the value of the assets bought by the central banks will go to zero and it will be like the money was never created.

Effectively all it is is a gigantic robbery where the bank’s debts were transferred to the public.

Wall St. is organised crime – once you realize that it all makes sense.

#

The goldbugs are interesting as the drivers of it are people making a living selling gold so they’re always looking out for signs of collapse but that makes them useful (with a pinch of salt) as the media is always doing the opposite – trying to paper over the cracks.

“So the central banks printing money and using it to buy toxic assets from the banks at face value didn’t add any money into the system”

to be clear it did nominally but in reality the banks were trillions in the hole and that money no longer existed

Aside from falling fertility, rising regulation, intrinsic barriers to innovation, These Kids Today (blame the soy or the porn or the birth control in the water or not getting smacked enough in the playground), a couple other possibilities:

a) A lot of 20th century growth was about extracting and using fossil fuels more efficiently. We’ve pretty much tapped that out. If you want a flying car, you need a new very concentrated energy source, and no one’s too keen about portable nuclear reactors flying around.

b) People seem to have a lot of time free during working hours; everyone’s website traffic is way up during those hours, for example. So that could mean that productivity is being mismeasured. Maybe we actually could produce almost equal quantities of widgets with most educated people working a lot fewer hours. That wouldn’t be more growth, but it would be something. (In the 50s, almost everyone predicted much shorter workweeks by the end of the century. We didn’t get them, but it’s not clear if that was a technological problem or just a few coordination problems around not seeming like a total slacker if you ask to work 20 hours a week.)

I’ve suspected that much white collar work could be done in far less time. There are still jobs where time put in equals amount of stuff done, but for an increasing fraction it certainly doesn’t seem to be.

“In the 50s, almost everyone predicted much shorter workweeks by the end of the century. We didn’t get them…”

partly we got them too soon – union strength meant the benefits of extra productivity arrived a few years early which is partly what led to the drive for cheap labor – but the cheap labor option is disastrous

A hint:

https://www.firstthings.com/blogs/firstthoughts/2016/07/americas-economy-is-cartelized-corrupt-and-anti-competitive

Goldman/Spengler is an idiot and a liar.

It’s true, he is.

How so? I’ve read a lot of writing and the word “idiot” does not come to mind, but I have not read everything he has written. Similarly, nothing comes to mind to suggest he is a liar.

Can you provide some examples that led you to this conclusion?

I’m genuinely curious. I’m not challenging the assertion.

Good point. Because I agree with you about Goldman/Spengler, especially with regards to his posting and I do challenge the assertion. The decline of entrepreneurship over the past 6 years is a problem that is being essentially ignored by the GOP in this election cycle. Trump say he wants to reduce the burden of regulation, and he may well live up to this promise if elected.

I think the reason why the people who are mad at Spengler are made at him is in result to something he wrote about the Confederacy and the U.S. Civil War about 2 years ago.

“The decline of entrepreneurship over the past 6 years is a problem that is being essentially ignored by the GOP in this election cycle. ”

If there’s no demand in the economy there’s no incentive for entrepreneurs to chase after a slice of it.

Perhaps so. But he is correct in this case.

Doesn’t this boil down to rent-seeking?

When people get wealthy, they “invest” in things like land, second third fourth homes, fine art, yachts, financial assets, etc. People are interested in preserving and maintaining their relative wealth and status. They don’t really have an incentive to risk their money to make other people wealthier and thus imperial their relative wealth and status.

So when wealth gets concentrated, it distorts the entire capital structure and directs capital towards bidding up things that are most inelastic in supply like land and fine art, rather than towards production and increasing supply.

This tendency was mitigated until the 70s because of the postwar dominance of Keynesianism, which focuses on the demand side of the economy. Keynesianism’s focus on demand meant that policymakers tried to maintain wage growth and government spending to prop up demand, which had the effect of creating greater consumer markets. The capital structure was healthier as a result. There was money pumped into the market for real things, so money chasing more money was incentivized to seek money in these markets. Orthodox Keynesianism was displaced in the 70s/80s by Monetarism, which effectively argued that there was too much money in the hands of consumers and government producing too much demand and bidding up the price of things other than the inelastic things the wealthy own like land, real estate, financial assets, etc.

yes – if you imagine the economy has three segments: subsistence, middle class and wealthy, then in a situation where the wealthy are siphoning wealth off from the middle class the middle class segment shrinks and the subsistence and wealthy segments expand.

the wealth extracted from the middle class doesn’t disappear, the wealthy have it but they store more and spend less of it than the middle class did- as you say

“So when wealth gets concentrated, it distorts the entire capital structure and directs capital towards bidding up things that are most inelastic in supply like land and fine art, rather than towards production and increasing supply.”

#

“This tendency was mitigated until the 70s because of the postwar dominance of Keynesianism”

Capitalism only works well when it is scared. When it’s not scared greed crashes it. After the collapse of the Soviet Union they stopped being on their best behavior and began the process of rolling back to the plantation. (which is another way of saying the same thing)

It’s just diminishing returns.

A few centuries ago there was a vast untapped pool of talented people. Tapping that pool resulted in growth, but all the people in the untapped pool were not equally talented. Now we are trying to draw on the dregs of the pool.

People are not fungible.

It has nothing to do with diminishing returns. Per capita growth is strongly correlated with productivity – and higher productivity means you can make more with less, including with fewer workers.

A new technology frontier usually requires a lot of bright, young people working in the industry, but as that technology ages, and higher productivity kicks in, fewer bright young people are required to labor in it.

So the next generation of bright, young workers move either to new industries or to downstream industries in similar technologies. So a man whose father was an engineer for Ford in the 1960s might work as an engineer for Sun Microsystems in the 1990s. Or a man whose father worked for HP in the 1990s might work for Google or Facebook today.

That’s how economies grow over the long haul. That’s how the U.S. has grown economically with remarkable stability over the last two hundred plus years.

There’s one major exception. Finance does suck up a lot of brains today, and I’m not sure the rest of us get much benefit from it. The productivity gains in other industries don’t seem to apply to finance.

productivity gains in finance are possibly destructive even – anti-productivity

I agree. I’m not too far from Paul Volcker when he says that the only useful thing the banks have invented in the last couple of decades is the ATM.

Automated bill paying and online banking save me time. So do debit cards. Banks can’t save me that much more time thru automation because I just do not use that much time dealing with banks in the first place.

Banks could get better at detecting attempts to fraudulently use identities: Basically better protect us from criminals.

how would gdp grow when fusion power would work? 100 % annually? 1000 % annually?

You might as well ask about when pigs fly; that’s probably more likely than fusion.

An investment of $20 billion might be enough to get the molten salt reactors (e.g., LFTR) going; that’s probably our best bet to cheap, clean, plentiful energy in the next 30 years.

Dudes,

Money is just a way to measure obligation.

Taxes are just a way to insure that we use the state’s money and not bitbucks or whatever other currency. The government knucklebutt’s have no idea what their role is. They truly believe we need to tax households to fund the government, unreal.

Deficit spending must occur in the public or private sector for there to be growth. The private sector does not have a monopoly on USDs, the gubbament does have a monopoly on USDs. Therefore, a private sector deficit is unsustainable. However, a public sector deficit is not only sustainable, but the natural way of things and should be encouraged. Don’t believe me, look at this graph:

Our deficit spending looks somewhat ok right now, could be a lot more, but the money is going to the wrong place. Bank reserves, which are a dead end. Loans create deposits, not the other way around. Warren Mosler is the guy to go to on macro flows and sector balances.

Bridges, roads, hospitals, etc., etc., etc. funded by the government and whammo bammo back in business. Add a major tax cut in and GDP will jump. Also, the government needs to incentivize people to get the hell out of the financial sector and law. There are a lot of bright minds being wasted on natural gas futures and tax law.

“Deficit spending must occur in the public or private sector for there to be growth. ”

This is just self-serving banking mafia nonsense – who gets paid the interst on this deficit spending?

the only real, non-illusory growth comes from p r o d u c t i v i t y

Annnd how do you go about funding this productivity?

If you’re creating more productivity you’re really talking about creating more obligation. If no one has money then they can’t buy your new widget. Who issues the money in your world?

If gov’t goes into surplus they have to take money out of household income. If you take money away from households they have less money to spend on your new widget. Your new widget company fails because people can’t afford to buy them. Leads to a reduction in productivity.

“If gov’t goes into surplus they have to take money out of household income.”

we seem to have slipped from deficit spending to surplus – if the govt has a surplus they can reduce taxes

(nb I’m not against govt deficit spending in all circumstances – for building and maintaining productivity enhancing infrastructure for example – the point is it should be genuine investment i.e. it adds more than it eventually takes out in interest payments)

(also there is zero reason why a govt should be borrowing from banks for this – it’s just a scam)

“Bridges, roads, hospitals, etc., etc., etc. funded by the government and whammo bammo back in business.”

If government infrastructure “investment” gets economies out of recessions why is the 1st world doing so badly? Every one of us has been running massive deficits for decades and our economies keep getting slower and slower. When the Chinese economy goes negative in the next year or two are you going to blame it on a lack of infrastructure spending? Give me a break.

If you actually read my comment I give an explanation. USG is not pumping money into infrastructure projects. They are pumping money into bank reserves. There is a huge difference. That goes for EU and Japan too. They’re all doing the same thing.

How do you explain that every time the gov’t runs a surplus we hit a brick wall recession? I would really like an answer.

I don’t see China going negative. If it does it will be due to massive fraud. Not because their monetary policy or their infrastructure spending was bad.

“I don’t see China going negative.” You are assuming that all those ghost cities will eventually get filled up:

http://www.forbes.com/sites/kenrapoza/2015/07/20/what-will-become-of-chinas-ghost-cities/#467692ed751b

I wouldn’t bet on central planning — it doesn’t have a good track record.

MMT adherents need to get out more. Australia nearly paid off it’s national debt around the year 2008. The debt they carry is a minuscule fraction of what the rest of the developed world suffers under. Bonus point, they haven’t had a recession since 1991. Governments don’t need to run a deficit to keep an economy moving. That is leftist nonsense.

http://imgur.com/a/39g8K

http://imgur.com/a/VlRCz

An apt nickname.

Australia is a net exporter.

http://imgur.com/a/FzhCh

Wrong again. Australia almost always runs a trade deficit. Anyway what does that matter? Just a few posts ago you claimed that if a country didn’t run a budget deficit it would go into recession. That’s clearly not the case down under. MMT is one step above Illuminati confirmed.

RJW you seem like a sincere guy so I’m going to help you out. MMT is a con created by an oddball named Warren Mosler. MMT does not describe how the economy works but instead describes a government-centered economy that Warren Mosler would like to create. In other words it is prescriptive, not descriptive.

Here is the dead-giveaway that MMT does not describe our current system.

1) The government doesn’t have to run a budget deficit to keep the economy humming.

Under our current system money is created when loans are originated. It doesn’t matter if the government floats a bond or you take out a 30 year mortgage. Bank loans bring money into existence.

Here are three common entities found in our economy.

A) Federal, state or city governments

B) Corporations

C) Consumers

Loans to these entities all create the same money. The government does not receive special or different money when it takes out loans. Therefor the government doesn’t have to run a budget deficit. All that is required to avoid a deflationary black hole is an overall expansion of credit. Sometimes governments keep countries out of recessions by borrowing lots of money but that’s not always the case. In Australia the national government has very little debt and credit expanded through consumer loans. In the end it doesn’t matter because it’s all the same money. Point this out to someone who believes in MMT and sparks will shoot out their ears. They think the government has access to some sort of special money. It doesn’t.

I don’t know where you’re getting the idea that I think the gov’t has special money. I think they are the issuer of money. If money was just slips of paper with my finger print on them I would have a monopoly on RJW Bucks. There is no reason I have to issue bonds for RJW Bucks because I can always make them. It is a policy choice in RJWorld to sell debt. You could just as easily make the policy choice to spend RJWbucks on fixing a bridge. You just make new RJW Bucks to pay the workers and buy the materials. This injects more RJW bucks into the economy. You can assure that people will use RJWbucks by taxing them. Taxes can also serve as a drain if inflation picks up.

As far as Australia goes, they have been net exporters in the recent past. The only way to fund a gov’t surplus is if the private sector or foreign sector runs a deficit.

“If government infrastructure “investment” gets economies out of recessions why is the 1st world doing so badly?”

They haven’t been using debt for that – if anything they’ve mostly cut capital spending – they’re using debt to pay the weekly bills (and some to bail out the banks).

#

“Every one of us has been running massive deficits for decades and our economies keep getting slower and slower.”

Debt-based consumption is inherently parasitic and destructive because you have to pay back more than you borrowed – so yes – the two are directly connected.

cheap labor stagnates the economy

– lower wages + higher housing costs -> less spending cash (reduced demand)

debt-based consumption stagnates the economy

– debt repayments -> less spending cash (net reduced demand)

tbtf banks stagnate the economy

– effect on low level investment

#

however all three benefit billionaires (in the short run) and that’s why they buy all the politicians, economists and journalists to lie for them

A contributing factor to the slowdown may be the way we manage and measure corporations: by ratio, for instance return on net assets, where you can either increase the nominator by growing, or reduce the denominator by outsourcing or investing in efficiency:a new logistics system, a new expense reporting system or what have you.

It’s a lot easer and less risky to reduce the denominator than it is to grow the nominator by investing in some new disruptive product. So managers invest in efficiency rather than growth. I see those decisions being taken repeatedly IRL.

Management by ratio started around the time spreadsheets were adopted at scale. 80’s.

This is an idea from Clayton Christensen, a very well known Harvard Business School professor. The other day I listened to him give an excellent talk over YouTube (Talks at Google, “Where does Growth come from”). He’s mostly famous for his theory of innovation.

There is still quite a bit of innovation and growth to get from computers and telecommunication, certainly; I’m in the innovation business and I meet quite a few people with fantastic ideas for changing the world with the use of computers and telecommunications. As that sector grows, the less important it gets in the overall economy.

But there is a lot more to be done with other science. For instance, materials science is giving a LOT of new material and it is not being adopted at scale yet. DNA manipulation has just begun.

Changing the contents of a normal MBA and changing the way our management cadre works is not easy, but at least easier than fighting a lack of new ideas.

the easiest way to increase profits is cheaper labor

so if that option is available capitalism will take that option

problem: wages = revenue

so when capitalism drives down wages initially it makes a lot of money and they lobby for more but gradually the economy stagnates because no one has any money to spend

so – capitalism needs to be restrained from the cheap labor option and helped to focus on the innovation option

#

the classic example here is fruit picking in California. if politicians had said no to cheap labor lobbyists back in the 1960s and instead set up a fruit-picking robotics MIT in SoCal California would be doing great.

The chart above provides the answer to your question. Once an economy becomes slathered down with too much unproductive debt relative to the size of its GDP it’s game over. Done. It’s exactly that simple. Japan proved this when they crashed 25 years ago in 1991 and never came back to life. Google economist Steve Keen for the details. The only way out of this mess is a massive default or massive inflation. Once most of the debt is cleared away the economy will reallocate and begin to grow normally again. But of course clearing away the debt means zeroing out the pension funds that hold the bonds. Politicians are scared of old people so the economy will stay in the dumper until it completely collapses. At that point we might get some reform.

Yes, high levels of private debt can be a problem. I think some good arguments can be made for wiping the slate clean at some levels of private debt. It would set things straight and incentivize creditors to actually do their due diligence when creating loans, instead of just bailing them out.

Again, this does not apply to sovereign governments in control of their own currency. Their natural state is in deficit if they are not net exporters.

http://imgur.com/a/kk7hp

Dang this was the chart, didn’t show up in my post above.

the banks successfully lobbied to get all the brakes removed one by one

http://imgur.com/a/2bsJJ

Sorry for the trifecta post. I just wanted to point out that Japan went bust back in 1991. That was long before adult diaper sales skyrocketed in the land of the rising sun. And yes the collapse was caused by too much speculative, unproductive debt. As per usual the rest of the world learned nothing from this painful le$$on in basic economics.

The Japanese stock market in 1991 was simply (with hindsight) overvalued.

Some people had a theory that Japanese per capita GDP could sustainably reach a level multiple times that of the US per capita GDP, because Japanese would work 100 hour weeks without tiring or complaining. Many of those people bet money on that theory, some of them a lot of money.

Turned out not to be the case and Japan’s stock market returned to valuations consistent with Japan achieving merely Western levels of productivity. But it could have been the case.

The Japanese state did not go bust in 1991 and Japan never really experienced a major recession.

http://imgur.com/a/LPT16

The reason Japan hasn’t entered a 1930s downturn is because the government continues to charge up the credit card to pump demand into the economy. But of course governments/currencies have debt limits too and this won’t last forever. All the debt will make the final crash that much worse.

They do not have debt limits. They have a monopoly on yen. They can imagine up as much of it as they want. They don’t even have to print it. They just mark up their account in the computer.

In a sense you are correct. When push comes to shove governments can print all the money they want. Venezuela is doing that right now. They’ve created 1000% worth of “stimulative” inflation, piles of cash and no products to buy with it. Brilliant.

Side note: as shown in the graph above Japan has spent as much money fighting their 25 year downturn as they did fighting WW2. They lost both times. Krugman styled stimulus doesn’t work. Case closed.

Actually from what I’ve read apparently Venezuela is not able to print it’s money on it’s own but needs to pay private firms to do the printing and then pay these firms in real money which it is increasingly running short of.

Venezuela has a currency pegged to US dollars. I think they should let it float.

“They do not have debt limits. They have a monopoly on yen. They can imagine up as much of it as they want.”

Yes, as long as you can balance external trade – if you need to import food then your currency has a limit.

Japan’s import-export strength allows them a lot more head room than Venezuela.

Agreed. And Japan’s terms of trade are probably always going to be better than Venezuela’s.

The 30s downturn was due to monetary policy mistakes. Japan hasn’t made mistakes like that. I think Japan’s debt splurge is bad but tangential. Would’ve been better if they hadn’t done it, but it neither caused nor averted any crisis. Japan is only stagnating today because the reduction in the size of the working age population is matching the rate of process improvement.

On a macro level, the advanced economies are demographically older, and therefore, less productive. They also import some sizeable fraction of third world helots, who won’t help per capita GDP (they may not help real GNP at all, though heaven help the economist who makes this argument).

Otherwise, what new and awesome technological innovations have taken place since 1970? Most of the ones I can identify do not help improve GDP/cap or GNP. Nerd dildo phones selling ads to people taking pictures of their lunch, or wasting time at work do not improve productivity in any identifiable way. There’s also genetic engineering technology, which allows Pepsi to create more diabetics, thus improving the output of the medical industry, but as medical care remains mostly a concierge kind of thing, that doesn’t really help much either. Computers have become more pervasive, and have probably improved productivity in some sense (long distance phone calls are cheaper, basically), but haven’t really brought any truly new capabilities that improve economic productivity.

Compare to the 40 years before 1970, when the slope of the line started pointing down. 1930-1970 saw rather more important technological changes than 1970-2010.

I can think of a number of reasons for stagnation ofincome at the median:

– Larger supply of slow skilled labor (thanks immigration).

– Big expansion of supply of cheap labor abroad (trade agreements, less communism).

– Technological changes that reduce the demand for lower skilled labor. Bye bye factory workers (and their lower level managers) and secretaries. Soon bye bye taxi and truck drivers. Their managers will also go bye byes.

– Technological advances in rent seeking.

– Decline in unions.